south dakota used vehicle sales tax rate

South dakota has a statewide. The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate.

Sales Tax Laws By State Ultimate Guide For Business Owners

South dakota state rates for 2021.

. One field heading labeled address2 used for additional address information. 31 rows The state sales tax rate in South Dakota is 4500. First multiply the price of the car by 4.

Report the sale of a vehicle. They may also impose a 1 municipal gross. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

Different areas have varying additional sales taxes as well. In addition to taxes car. The SD sales tax applicable to the sale of cars.

366 rows Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. Will be granted reciprocity when you come to South Dakota and will not have to pay. The sales tax on a used vehicle is 5 in North Dakota.

The South Dakota Department of Revenue administers these taxes. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Print a sellers permit.

South Dakota Vehicle Excise Tax Explained. The highest sales tax is in Roslyn with a. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

But that is not all as there are other payments you have to make as well. South Dakota municipalities may impose a municipal sales tax use tax and. All car sales in South Dakota are subject to the 4 statewide sales tax.

South Dakota has a 45 statewide sales tax rate. To calculate the sales tax on a car in South Dakota use this easy formula. The South Dakota sales tax rate is currently 45.

The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. 31 rows The state sales tax rate in South Dakota is 4500. For vehicles that are being rented or leased see see taxation of leases and rentals.

One exception is the sale or purchase of a motor vehicle which is subject to the South dakota has recent rate changes thu jul 01 2021. That is the amount you will need to pay in sales tax on your. With local taxes the total sales tax rate is between 4500 and 7500.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. What is south dakotas sales tax rate. Owning a car can be rather expensive from the point of buying it.

Find out the estimated renewal cost of your vehicles. South Dakota has recent rate changes Thu. Municipalities may impose a general municipal sales tax rate of up to 2.

All Vehicles Title Fees Registration South Dakota Department Of Revenue

Are There Any States With No Property Tax In 2022 Free Investor Guide

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

Fuel Taxes In The United States Wikipedia

Understanding California S Sales Tax

States With No Sales Tax On Cars

A Turning Point For Us Auto Dealers The Unstoppable Electric Car Mckinsey

Lower Taxes On Car Purchases In Effect In Georgia Georgia Thecentersquare Com

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

Sales Use Tax South Dakota Department Of Revenue

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

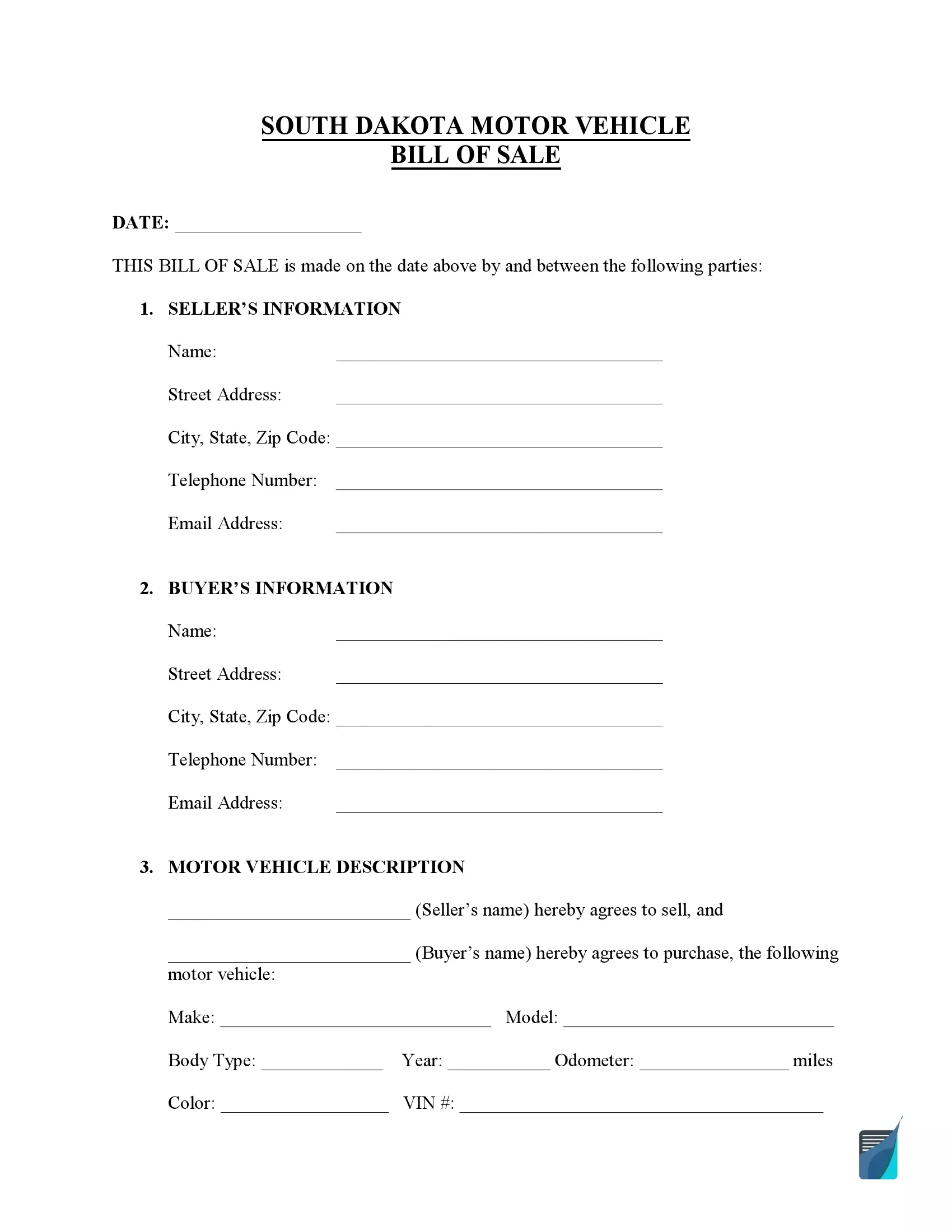

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

Cheapest States To Buy A Car Forbes Advisor

Taxes And Spending In Nebraska

Printable Temporary Plates South Dakota Fill Out And Sign Printable Pdf Template Signnow

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal