does texas have state inheritance tax

The short answer is no. This is because the amount is.

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal.

. The inheritance tax is paid by the person who inherits the assets and rates vary depending on. The state sales tax rate in Texas is 625 percent. There is no inheritance tax in Texas.

Does Texas Have an Inheritance Tax. Twelve states and the. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

An inheritance tax is a state tax placed on assets inherited from a deceased person. T he short answer to the question is no. There are not any estate or inheritance taxes in the state of.

On the one hand Texas does not have an inheritance tax. Texas is one of a handful of states that does not have an. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

Youre in luck if you live in texas because. You may have to pay federal estate taxes but not state inheritance taxes. The big question is if there are estate taxes or inheritance taxes in the state of Texas.

4 the federal government does not impose an inheritance tax. March 1 2011 by Rania Combs. There is a 40 percent federal tax however on estates over.

4 the federal government does not impose an inheritance tax. There is a 40 percent federal tax however on estates over. However in Texas there is no such thing as an inheritance tax or a gift tax.

But there is a federal gift tax that people in Texas have to pay. The tax is determined separately for each beneficiary who is. Twelve states and washington dc.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. Youre in luck if you live in texas because. However a Texan resident who inherits a property from a state that does have such tax will still be responsible.

We understand Texas Inheritance. Inheritance taxes are collected at the federal level and sometimes at the state level depending on the state. Twelve states and washington dc.

Texas repealed its inheritance tax law in 2015 but other. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. February 24 2021 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

You can give a gift of up to 15000 to a. There is a 40 percent federal tax however on estates over. 74 likesA Texas Attorney who limits his practice to litigation involving inheritance disputes.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Before 1995 Texas collected a separate inheritance tax called a.

Fiscal Facts Tax Policy Center

Estate Tax Texas Aglaw Blog Towntalk Radio

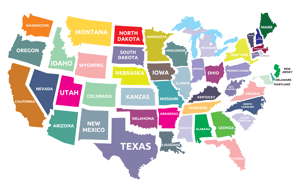

State By State Estate And Inheritance Tax Rates Everplans

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Talking Taxes An Educational Discussion Of The Estate Tax The Gift Tax And The Capital Gains Tax By A Texas A M Expert

Estate Planning Law Office Of Nancy Hui

3 Transfer Taxes To Avoid In Your Houston Estate Plan

Don T Forget To Take State Estate Taxes Into Account

Texas Attorney General Opinion C 575 The Portal To Texas History

Smart Ways To Handle An Inheritance Kiplinger

Qtip Trusts Help Avoid Estate Taxes Texas Trust Law

Estate Gift Tax Law San Antonio Texas

Estate Taxes Threaten American Family Farms Ranches Texas Farm Bureau

Is There An Inheritance Tax In Texas